Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Everything You Need To Know About Running Payroll In Malaysia

Flat rate on all taxable income.

. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24. Total tax reliefs RM16000. Personal Tax 2021 Calculation.

Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN. Personal Income Tax Rate in India averaged 3239 percent from 2004 until 2020 reaching an all time high of 3588 percent in 2018 and a record low of 30 percent in 2005. Chargeable income RM20000.

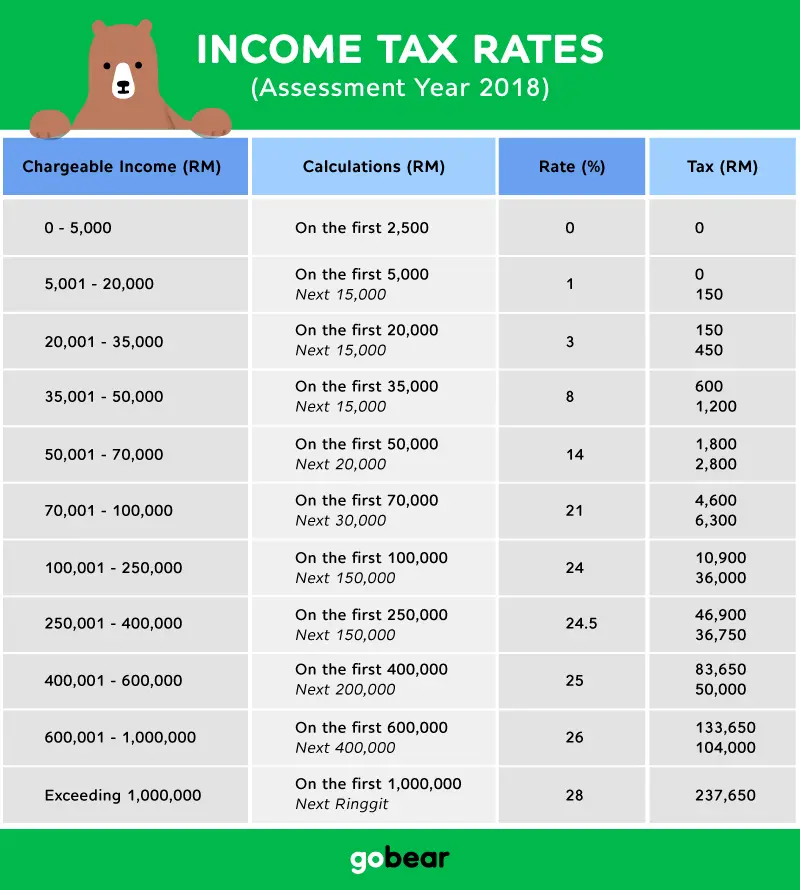

Not that not all tax rates and thresholds in Malaysia change annually alterations to tax policy to support strategic economic. Find Out Which Taxable Income Band You Are In. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Purchases of books sports equipment smartphones gym memberships computers and internet subscription are allowed up to RM2500 tax relief. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Zambia Last reviewed 01 June 2022 375.

Tax residents are subject to PIT on their worldwide employment income regardless of where the income is paid or earned at progressive rates from five percent to a maximum of 35 percent. Ali work under real estate company with RM3000 monthly salary. Zimbabwe Last reviewed 22.

No other taxes are imposed on income from petroleum operations. The income tax rates 2021 exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each. Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Tax Rate Taxable Income Threshold. These Are The Personal Tax Reliefs You Can Claim In Malaysia.

How Does Monthly Tax Deduction Work In Malaysia. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. Personal Income Tax Rate in Bangladesh averaged 2694 percent from 2004 until 2021 reaching an all time high of 30 percent in 2014 and a record low of 25 percent in 2005.

This page provides - Bangladesh Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Taxes including personal income tax expenses and limitations are reviewed by the Government in Malaysia periodically and typically updated each year. There are no other local state or provincial.

See Vietnams Individual tax summary for rates for non-employment income. The Personal Income Tax Rate in India stands at 3588 percent. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

Annual income RM36000. This page provides - India Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

A flat tax rate of 20 for employment income. Additional RM2500 tax relief for purchases of personal computers laptops smartphones and tablets made between 1 June 2020 until 31 December 2021. Total tax amount RM150.

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. The main objective is to help taxpayers who have lost their jobs due to the current pandemic. Income Tax in Malaysia in 2021.

Progressive rates up to 35 for employment income. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. The Personal Income Tax Rate in Bangladesh stands at 25 percent.

Cukai Pendapatan How To File Income Tax In Malaysia

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

How To Calculate Foreigner S Income Tax In China China Admissions

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysia Personal Income Tax Guide 2022 Ya 2021

7 Tips To File Malaysian Income Tax For Beginners

Malaysian Personal Income Tax Pit 1 Asean Business News

Income Tax Rates Malaysia Maximilliandsx

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Individual Income Tax In Malaysia For Expatriates